Although the event was a big success there were quite a few notable absences... There were representatives from most of the normal SatNav companies, but both TomTom and Garmin did not send their senior management teams, and there was no representation from NavMan, Mio and some of the smaller manufacturers. The market sector that was missed most though was the cell phone operators, with Orange the only wireless carrier in attendance. That said we had people traveling from all the continents around the world to join in the discussions. Although the event was a big success there were quite a few notable absences... There were representatives from most of the normal SatNav companies, but both TomTom and Garmin did not send their senior management teams, and there was no representation from NavMan, Mio and some of the smaller manufacturers. The market sector that was missed most though was the cell phone operators, with Orange the only wireless carrier in attendance. That said we had people traveling from all the continents around the world to join in the discussions.

As usual we had a number of Keynote speeches, but the majority of the more interesting information was passed during the many networking sessions that took place during intervals and during the Gala Evening meal.

In fact I spent most of the evening chatting to Kanwar Chadha (the founder of SiRF) and Li Lei Tsien (Centrality now part of SiRF) discussing the potential future of GPS applications. Most of this was concepts and dreams, but with a firm rooting in practical solutions. We all agree that SatNav in the form that it is currently is only the very tip of the iceberg in the vast range of uses that GPS can be applied. Kanwar did not deny that camera manufacturers will soon be embedding GPS into digital imaging systems, with the emergence of community projects such as Flickr and the ease of use of Google Earth it is almost a foregone conclusion that all devices that create files will have the GPS location embedded within them. If you are a regular reader of my articles you may realise that this is a function close to my heart.

The other main topic of discussion both during the keynotes and the networking sessions was connected devices. This requires a connection to the Internet either via a PC or more usefully via some form of mobile connectivity. Nokia (not surprisingly) were anticipating that they will be leading the way as the N95 and 6110 Navigator have both GPS and wireless connectivity already built in to their hardware systems. Others were predicting the arrival of PNDs with a slot for a SIM card (TomTom already have one for their business solution TomTom Work) whilst others were ignoring the connectivity and just focusing on the potential usage models.

In fact the most important link in the entire system is the mobile operator, which of course was missing... This is probably the most critical part of the implementation of dynamic link for systems and a number of crucial questions need to be addressed before we can have a realistic implementation. In fact it would appear as if we will have the applications waiting for live data and the data ready to be delivered, but the conduit will not be there. It was suggested that the carriers got burnt back in the early part of the decade getting caught up in the hype of Location Based Services when there was neither the content or the applications to support them. This may be making them wary of joining the market now. Alternately they may not see any significant revenue stream in these applications and prefer to direct their effort into areas perceived to generate more profit.

The introduction of the iPhone (Apple were not there either) though it is not a GPS device, and Nokia's determination to enable most phones with GPS may make the carriers start to re-evaluate the market sector again. I certainly hope so. There are other initiatives such as E-911 which has driven the US Location Based Services ahead of us in Europe, and the E-112 mandate for Europe these can provide the infrastructure and rationalisation for the carriers to re-evaluate their position.

Rant over. Time to get back on track.

There were a lot of potential applications and proposals for advertisement based solutions to provide dynamic data to GPS devices. The obvious application is traffic data, but can instantly be expanded to include downloadable maps, POIs, travel guides and other related content. This is of course focusing on applications within navigation. Moving away from dedicated navigation the dynamic channel can be used to provide results for local search. Imagine hitting a button on your phone and the list of open local chemists appears on your phone. You could then hit the dial button and check that they have what you need and then a further button can navigate you directly to the front door.

Again knowing where you are and the time allows you to do some smart searches. For instance you can plan a multi modal journey taking in a variety of transport methods including identification of the nearest bus stop, when the next bus is due, the connections you need to make to a local train and then the final walk to your location. This is not science fiction this is a current reality.

These are just simple examples of what could be done with the current technologies as long as the entire infrastructure systems and costings are in place. As ever this is not as simple as it would appear as there are a number of parties that need to be coordinated to achieve this. We have the technology all we need is the drive. There are a number of companies providing aggregation of data but each navigation company is likely to want to create their own portals and "own" the client. This is possibly one of the major sticking points at the moment. These are just simple examples of what could be done with the current technologies as long as the entire infrastructure systems and costings are in place. As ever this is not as simple as it would appear as there are a number of parties that need to be coordinated to achieve this. We have the technology all we need is the drive. There are a number of companies providing aggregation of data but each navigation company is likely to want to create their own portals and "own" the client. This is possibly one of the major sticking points at the moment.

One solution would be for an advertisement based service with the costs of the service (data and airtime) being subsidised by advertising over the channel this will obviously only work for discrete services where a banner can be displayed subtly and unobtrusively in the returned data. With integrated solutions where the information is aggregated into the navigation interface the advert would not be displayable, and indeed could be regarded as dangerous. This of course does not apply for pedestrian applications or where the request is made when you are stationary.

My personal opinion is that LBS delivered to a mobile device could rapidly outstrip the traditional Navigation application with navigation becoming just one service of your device. I am using the term device here as it is entirely possible to build this functionality on top of the current solutions ie the connected TomTom or Garmin SatNav devices indeed one of the strengths of the ALK CoPilot solution is that it is primarily implemented on connected devices so these features could very quickly be implemented.

So far we have really only seen the "small" navigation companies in the market space. I expect that now Nokia has become a major player it will not be long before Apple join in and then possible one of the "big boys" like Microsoft, or more likely Google. There have been lots of rumors surrounding Google, but none have come to fruition yet. Watch this space... So far we have really only seen the "small" navigation companies in the market space. I expect that now Nokia has become a major player it will not be long before Apple join in and then possible one of the "big boys" like Microsoft, or more likely Google. There have been lots of rumors surrounding Google, but none have come to fruition yet. Watch this space...

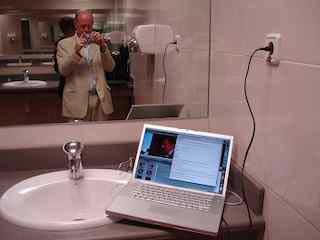

There were also a few funny moments this week as well. The first being the start of a presentation by explorer Andreu Mateu who had the whole auditorium massaging each others shoulders then jumping up and down waving arms and shouting. The last was me trying to write this article. After 2 hours in the departure lounge at Barcelona my batteries died. I hunted high and low, but the only power outlet I could find was in the bathroom. Check out the pictures of my latest office...

Keynote Speech Highlights:

The first keynote speaker was Chris Jones VP and Principal Analyst of Canalys.

Chris predicted that the US will hit new heights this year. Western Europe dominated the market with a 70% share last year but this has dwindled to 54% with the US market rising from 15% to 27% mainly off the back of special promotions. Asia and Latin America have huge potential with the increase in coverage of mapping and product awareness. The Market is booming there is still room for plenty of growth. Chris predicted that the US will hit new heights this year. Western Europe dominated the market with a 70% share last year but this has dwindled to 54% with the US market rising from 15% to 27% mainly off the back of special promotions. Asia and Latin America have huge potential with the increase in coverage of mapping and product awareness. The Market is booming there is still room for plenty of growth.

Market coverage

TomTom still the leader of all SatNav systems, but Garmin leads in the PND category. Nav N Go has jumped into 3rd position with Navigon and Magellan filling out the top 5. Networks in Motion (Blackberry) is in 6th position with their off-board (over the air) navigation solution. Offboard and onboard navigation is growing on mobile phones in Europe but it is not as successful as it is in America where the GPS capability is built in to the mobile handset.

PNDs What is next?

Connectivity is on the horizon. Dash navigation has probes for dynamic traffic. TomTom has Work. Connectivity is possible with built in WiFi and SIM cards for networked communications, but convergence brings many challenges. One of which is fixed rate data plan and roaming costs. Canalys expect these to be introduced in 2008 and possibly with aggressive pricing from the Wireless carriers. One of the barriers is the back end supporting systems. In a survey Canalys found that very few people visited the vendor's web sites. These need to be integrated into the entire navigation experience and provide a seamless user experience.

Connected functionality priorities:

A European Survey showed the following requirements:

- Live Traffic

- Map Updates (TT was getting 60,000 map error reports a month)

- Live changes ito maps

- Downloadable content guides and POIs

- Offline route planning

- Website browsing (as per iPhone)

- Buddy locating

- Location based services

Technologies

Nokia is streets ahead in the smartphone navigation market. Driving innovations such as built in GPS with the 6110 Navigator and the N95. Key mobile phone requirements are identified as:

-

Internal GPS

- Fast Fix times

- Indoor coverage

- Simple user interface

- easy to use keyboard

- form factor issues will remain small screen and numeric keyboard

- Flat rate plans

Next year vendors will start to integrate with internal car systems ie using the car video displays. This can remove some of the technology issues but to get fully connected systems we need

mobile operator support which is far the most important factor to the success of the networked Navigation 2.0 systems.

Chris then made a comparison between the capabilities of onboard (stand-alone) and off board (central server based) systems:

On Board

Route calculation and navigation

Basic local maps

Personalisation

POIs

Speed Cams

Historical info

Traffic Data |

Off Board

Route calculation and navigation

Downloadable local maps

Personalisation

POIs

Speed Cams

Historical info

Traffic Data

Off board can offer much richer content

Wider map coverage

Dynamic content POIs etc

User generated content download on the fly

Map updates

Live traffic

Directory integration

Buddy services

Route sync

Multi modal transport (Train/Bus/Walking) |

Navigation 2.0

Navigation 2.0 is all about community and sharing. This allows user generated content to be included into the navigation systems and adds a much richer environment for your navigation experience.

User generated content can include:

- Content error generation (map errors)

- Route recommendations

- POI Reviews

- Geo-referenced photos

- Community portals

Most people don't connect the Navigation system to a PC. We (the SatNav Industry) need to generate a reason for people to want to connect and share.

Market Volumes

In 2010 the market could pass the 100M units aided by China and India and the changing strategies in mobile phone companies such as Nokia. If the Mobile Carriers enter the marketplace then this could be an order of magnitude larger.

Alain de Taeye CEO Tele Atlas.

Community Input: A new era in digital mapping.

Navigation is coming out of the car and into the hand. Mobiles are starting to take over. Phones have evolved from making audio calls to providing a micro multimedia computer. Navigation is evolving in the same way. Navigation is coming out of the car and into the hand. Mobiles are starting to take over. Phones have evolved from making audio calls to providing a micro multimedia computer. Navigation is evolving in the same way.

Maps originally allowed people to get from A-B, then additional content was added with POIs (but still only covering a fraction of the real world). Now we have added services in the form of

Dynamic data such as traffic and position reporting.

The overriding User requirement is for the data to be error free and accurate.

As we move into different areas of data collection and usage the challenge is to create processes to increase the accuracy and reliability of the mapping.

One issue facing the industry is persuading the users that they need to update maps (and pay for them) Most journeys are through known areas so navigation is not a requirement. Additional value added services are required to encourage users to update and subscribe.

Processes and surveying need to be changed to allow daily mapping updates. The revolution is to include the user community to help provide survey data and mapping corrections using millions of volunteers but the community needs to be involved in smart ways.

Last year Mapinsight was introduced by Tele Atlas for user feedback.

But Mapinsight relies on a number of features such as user motivation and memory of the error. It is not location enabled and is defined (by Tele Atlas) as Active Reporting. A far better and more accurate method would be Passive Reporting.

Passive information uses "probes" to collect information ie the TomTom/Vodaphone real time traffic info (though this not related to a GPS system).

Using any available probe can improve the data. It is more statistical than detailed and the statistical analysis can lead to higher accuracies including features like reversal of one way systems etc. All this can be achieved without the user's conscious input.

One of the most useful features is speed profiling the collection of statistical data can predict traffic flows and accurate journey estimates.

These will still be concatenated with external TMC/weather data etc

The TomTom/Tele Atlas merger

The concept of the merger is to gain access to community feedback and incorporate the data into the core data.

Once the data is available and processed it needs to be distributed as quickly as possible.

This new feedback improvement process will assist all users of Tele Atlas maps not just TomTom.

Mapshare will be integrated into Tele Atlas's core products but will just be one of the core technologies, there is nothing preventing other Tele Atlas clients providing a similar feedback feature.

There are two ways of looking a the future.

1: Continue what you do successfully now.

2: Innovate to improve the products and reach new heights.

Tele Atlas have chosen the later in an effort to lead the market from the front.

Michael Halbherr VP Nokia Multimedia (Ex Gate5)

Pushing the boundaries of location based experience

"Navigation is a function posing as an industry" A bit of a provocative statement but Michael went on to explain that Navigation is just a single function of the GPS enabled devices. We should be opening our minds and service offerings beyond navigation and into the provision of location aware content. "Navigation is a function posing as an industry" A bit of a provocative statement but Michael went on to explain that Navigation is just a single function of the GPS enabled devices. We should be opening our minds and service offerings beyond navigation and into the provision of location aware content.

Nokia maps core functionality will be maps, routing, navigation. Available in over 70 countries with the navigation being a chargeable product. Nokia are active with over 270 operators worldwide, the issues of localisation and travel are made complex with each of these wireless providers having disparate systems and implementations of data etc.

Across the Nokia N95 mobile phone market Nokia maps is a top 5 application after messaging, camera,web,and music. It is still actively used after a month after purchase. Nokia Maps is activated by 100% of N95 users. Initial problems with TTFF were overcome using an operator independent over the air solution. Users are still "playing" many weeks after purchasing, as well as real time use for navigation. Use cases are drive 67%, walk 57%, cycle 7%, Plan and discover 44% (searching current location). Nokia Maps is not designed as a replacement for in car navigation, but to complement it with a fully mobile location aware service.

Nokia Maps 1.0 is really the first step into the technologies to discover what the real user wants from the applications. Nokia are also using the system to create geo-referenced cell locations so all phones can be located irrespective of GPS facilities. The world mapping fits onto 4GB store card.

Nokia Maps is an "Integrated Experience"

offering "Over the air" maps as well as "Side-Loader" which allows you to download the entire world off line (well online but on your PC as opposed to the phone). The software has evolved with feedback from user experiences.

Michael calls the Nokia "the 4th screen": Cinema, TV, PC, Nokia. With the 1 Billion Nokia phones landmark approaching the 4th screen is a huge market.

Nokia strategy is about convergence. Locating the source of a phone call, SMS, picture etc. Web 2.0 is about communities... The Nokia GPS hardware technology can create geo-based communities. The hardware device is not enough though and Nokia's next level of integrated environments will start to address that with a move from products to experiences.

OVI (Finnish word meaning door) is the door to online experiences, a onestop open access point to your communities. Geo-referenced pictures uploaded directly to flickr. Nokia's view point is not compartmentalised internet (PC, mobile, WiFi) it is just internet... It is not product it is an experience transcending hardware boundaries and moving into real life usage models. Connecting people in new ways, in particular using location and shared data!!!

Panel Session: Where is navigation going?

2009 will see some automotive connected products with the functionality of today's PNDs at a price point of €500 as an option. 2009 will see some automotive connected products with the functionality of today's PNDs at a price point of €500 as an option.

Nokia will remain consumer driven, and suspect that screens will get larger with higher resolution as per the iPhone as long as the user demand requests it. It is suspected that the iPod will be dropped soon in preference to the iPhone as this is a connected device and will perform all the iPod does and more.

The panel also believed that speech technologies would improve dramatically both in terms of TTS but more importantly in voice recognition as the data input mechanisms is

Data content protection and validity issues were raised. Nokia believes the best way protect content is to make it free, and base business around an advertising model. Alternatively the data content pricing is bundled into the price of the unit. This could effectively make the use of the device and data free, but there needs to be a fair implementation of revenue sharing. Mobile phone operators are used to controlling the whole product cycle, but must be prepared to start opening up and sharing content and revenue with alternate providers.

With the rise of Navigation 2.0 and input from the communities there was a concern that data could rapidly become corrupt, unreliable and invalid. Community feedback and updates need to be validated and verified. This will help to prevent fraudulent reporting.

Battery life issues, with the increase in hardware technology the battery becomes a critical point. The approach is to develop smaller and more efficient silicon solutions which are frugal on power usage. The silicon is being tailored specifically to the application rather than using generic chips. Nokia use smart power management like putting modules to sleep when they are not required. The AGPS can be used to regain a fix very quickly. There will always be balance between available power and features, the more power available the more features will be added or developed to utilise it.

Jacques Garcin Telematics and Automotive Director Orange

Connected services and navigation for a new traveler experience

Navigation is not the core business of the Carrier or Telco, but they are very interested in the development. The core business is and will remain voice. However new services are emerging to meet a demanding market. In particular Orange is developing New services and the connected car.... Orange Navigation! Navigation is not the core business of the Carrier or Telco, but they are very interested in the development. The core business is and will remain voice. However new services are emerging to meet a demanding market. In particular Orange is developing New services and the connected car.... Orange Navigation!

Communicating is vital and has been for a very long time from the days of Indian smoke signals to cellular phones. Voice is the mainstay of the carriers business. Orange has worked closely with voice in the car with manufacturers such as Ford, Peugeot, Citroen, Toyota and Fiat amongst others. You always travel with you keys, wallet and mobile phone. The keys open your car, but the phone opens up your life...

Orange are working on technology to remove the need for car keys, the phone will become the key to the car with software transferable between phones to activate your vehicle.

They are adding GPS and tracking to their services to complement existing services, including Traffic webcams and internet services. this will allow you to browse real live traffic video on your device. They are working toward embedding systems into cars to provide the same services as the office via car computers and wireless technologies. At the end of September one car manufacturer will be releasing a seamless Orange car communications solution. The details of who it is were not forthcoming.

Orange are producing an architecture to deliver real time traffic features. They are showing the foresight to develop pan-european and global solutions. Despite promising the underlying architecture there was no mention of addressing the important business decision makers concerns such as flat rate data and affordable roaming.

They sees their role in Fixed and Mobile internet online and offboard services, delivery platforms, and innovative solutions for cars and services for GPS enabled phones. The underlying architecture should always deliver the best communications solution from GSM through to WiFi and WiMax. The services are in place and ready to deliver the services required for tomorrows users...

Orange Navigation GPS and LBS will be the revolution of the coming years. Navigation and LBS are their top priorities along with music and video. 63% of users have indicated an interest in using navigation on the mobile phone. The devices are on the way, but it is expected in 3-5 years before the majority of users will have these features in regular use.

Kanwar Chadha Founder of SiRF

Navigations to Locations: A Battleground of Convergence Connectivity and Content

What is the killer LBS application? What is the killer LBS application?

TIME!!!

Your Watch is your time machine, it is available in a number of forms, but is most convenient when viewed on your wrist. If your time is on the phone it can be regarded as a 3 click solution compared to the watch (1 click)

LOCATION!!!

The location is the key to Location Based Services. In fact Location Based Services should really be LES: Location Enabled Services. The killer application is a combination of awareness intelligence information based around the attribute of location.

The challenge of implementing GPS for location based services was mainly size and power, and traditionalists called Kanwar crazy to

dream of these applications. But the implementation must be realistic for the target market, and there is no single solution for all users. The usage model is very important. An older person in a car has different requirements to a mobile teenager. For this reason there will be a number of types of device with a GPS Enabled phone the preference of the younger generation, and a PND the choice of the road warrior. In the same frame of thought a heavy music user may want occasional navigation, whereas a phone user may only occasionally use it as a music player and less as a navigation device. Kanwar sees the current usage models and functional groups remaining rather than converging into a single device.

The expanding navigation market started as a luxury addition in cars and moved to portable market (in 4 years it has doubled the size of the global in-car market). Now we have moved to personal devices . We are also seeing the movement from navigation only systems to multiple usage devices including hands free, traffic, and entertainment, now we have also started a move to add office features and internet. We are beginning to have location aware devices (with navigation as a function) these are feature rich but are 3 click devices.

The main drivers of the new devices can be summarised as:

Geo Search : The driver for new content based services

Google Local : Google earth on the move

MS Virtual Earth Windows Live local

New Business models

- Location based advertising revenues

- On demand content and service

Operators

Are continually looking for addition revenue streams for each unit

Mandates

Originally the E911 in the US is being followed by E112, and E110 in Europe.

Operators had to comply with e911 by introducing GPS into phones but now operators are introducing GPS as a core feature despite the mandates.

Location awareness is the core enabler of the new services. Rich content is important especially personalisation including time sensitive data, based on specific user profiling. The content services need to be backed by reliable infrastructure. Technology and mapping data need to be fast, robust, accurate and reliable.

The Future of Location Enabled Devices

Phones with entertainment and navigation (Nokia)

Navigator with Entertainment and wireless capability (TomTom, Garmin etc)

Entertainment device with navigation and wireless (Apple)

The future may be led by branding and style... but there may not be a complete solution a Car based system may get connectivity features as well as LBS enabled on other devices

Computer and camera integration understand where the device is... Location will become part of our community. Location will become taken for granted in society. The new generation will bring Location 2.0 forwards with social integration.

SirF are generating a number of core technologies to enable platforms Stand alone System on chip and embedded. They are also providing software tools to integrate into solutions: SiRFStudio for developers, LocativeMedia for marketing and SiRFsandbox for testing.

Breakout session Operators and LBS

Alain Dardoullier Device Development Manager Orange France Telecom.

In the period 2000-2003 LBS was massively hyped, with very little realisation and customer disappointment. Recently these services have improved with the development Orange Navigation (currently being trialed in France and Spain).

In the early years development was held back by the technology with positional accuracy using cellid at around 200-500M not precise enough for accurate positional information. At that time the technologies were not standardised and there was poor content to support the services. There was little or no integration to Web 2.0 services and little marketing understanding and communication. The hardware platforms were complex and difficult to use. This eventually led to the failure of LBA and possibly a reason for the reluctance for the Wireless Operators to move back into the market now.

The customer perceptions of current service is improving with Orange Local in the UK and Orange Navigation. Getting feedback about improvements such as adding dynamic content ie bus timetables etc also criticisms and feedback are being taken on board and used to improve the services offered.

The technology has advanced with more sensitivity and faster fix times a matter of a few seconds when AGPS is used. The content is continually improving as are the maps. As a commercial prospect to operators and carriers this is now becoming a very viable revenue stream.

The introduction of A-GPS devices is a key factor in the success of the LBS services, this is also combined with a continuing trend in the drop of average prices. The capabilities are now being integrated into mid and low range devices. At the high end the SPV M650 was a good integrated PDA solution with high and sustained sales.

Orange identify the "use cases" as:

MapMe

Guide me

Share This

Find Nearest

Orange have been running Map&Go service trials in France and Spain this year with links to integrated trip planning on the PC or Internet. Map&Go allows planning across multi modal travel systems Metro, bus, and walking. This allows both stored itinaries with local maps and real time GPS guidance. It also allow you to do a GPS location based search to find a business such as restaurant, then you can dial to the provided number and set the destination to navigate to the address of the business.

Key features required for Map&Go service: Fast GPS fix and responsive online server, 3G increases the practicality in real use, content must be varied and current.

Trial Results

Multi modal very popular,

real time info traffic, time tables etc

Rich content and offline planning

Issues

GPS is perceived to be Car navigation

Price sensitivity is an issue with ownership also confusing and no perfect price model

Accessories for pedestrian navigation or car navigation. Car cradle and charger are essential.

Orange perceive that 2007/2008 will be a landmark year for LBS: customer awareness has been greatly increased, the technology is mature (AGPS, 3G, Displays), Service trials are positive and looking good for low cost mass market implementations.

Magnus Nilsson Wayfinder CEO

Wayfinder's Vision

Every mobile will have GPS

Marginal cost for data (flat fees)

Good network availability

Becoming leading brand in mobile location AGPS and services

1 stop shop for operators and handsets

Data transfer will be financed by advertising (1st real deal signed last week)

Background

footprint 150m users globally

More than 1M active users

100% Per Annum growth

Platform in dependant java, Symbian,Microsoft, Microsoft

Technology independent with On and off board solutions working together.

Founded in 1995 as an Ericsson research project prior to Sony Erricsson merger.

Mission

World leading supplier of geocontent and location services

1m+ users (already achieved)

Well defined position in the value chain. With Wayfinder to be the partner of choice for operators

Easy local search

Products

Wayfinder Earth Beta (Google Earth on mobile free)

Wayfinder Navigation

Wayfinder speed alert:

speedcams and incidents with 17k cameras over Europe

Wayfinder access :

TTS navigation for visually impaired people. Featuring spoken POI info

Wayfinder outdoor

Community based product for route and place sharing.

Application FOC but maps are chargeable.

Technology

Development of a Location aware server was the result of the Ericsson research projects. This allows for user centric location aware services with built in capabilities for operators.

Features

Power search enabling advertising income

Map experience compression techniques with streaming data packages

Navigation

Scalable infrastructure

Platform independence

Vital Elements

Device independence, price transparency ( difficulty understanding cost of service is perceived by users as an inhibitor), Simplicity, Entertainment value.

AI in austria charges €6 a month for the wayfinder service pre-installed which was a fixed cost including data charges.

Future

Extended Map data

dynamic data

Aggregation of user input

Hans Hendrick Jentro

We are still in the very early days, less than 2% penetration of the European market. Hans highlighted the fact that there was only one operator (Orange) and that they (the operators) needed to be brought on board before we can really move forward.

My World on My Phone: The important concept is that it is "My World" not the whole world so content would be filtered and personalised to your individual requirements.

Phone Navigation is a reason to buy not to use!

People buy devices not services...

Difficult to create hardware USPs against PNDs screens, dedicated devices.

Try buying a mobile navigation product at a retail store. The stores have great difficulty selling the sort of technology that a lot of them do not have detailed knowledge of, and with no support from the network operators.

Users want free content but are prepared to pay for unique, specific content. This includes music, ring tones. As long as the content is perceived to be of value then they will pay for it.

Branding is also important. Do operators want to become navigation brands or do they want to partner with existing brands and revenue share?

Navigation and location based services could be a big driver for data services. There could be models developed with advertising providing the revenue stream allowing operators and partners to provide free data and services, removing the onus of payment, and the fear of high bills, from the users.

Winston Guillory Senior VP Consumer and Enterprise Navteq

Going beyond Navigation: The Power of Where

Winston highlighted the ability of Wireless and phone operators to open the floodgates simply by defining a product direction towards navigation and LBS that could expand the market tenfold.

The enablers for this massive market expansion are the 3 Cs: Content, Community, Connectivity

Content

Initially the mapping defined the Road network, then over time new static content was added such as POIs.

Now the move is from Static data to Dynamic content enabling a much richer set of data and more relevant information to be presented to the end user.

Discover Cities feature rich data which focuses on multi modal transport, walking, cycling tour guide, etc.

Navteq are looking to expand content from a variety of sources such as fleet companies/couriers, Merchants, and venues/events (mapnetwork). Mapnetwork allows near real time poi data around a particular location to help promote events and facilities.

With the addition of device connectivity the data set can be extended to include dynamic data. This is the enabler for Location Based Services. A prime example of location sensitive data feed is traffic information.

Community

Larger content Community required

Traffic remains a killer application but broader coverage and more accurate needed

Analysts believe that the growth is just beginning... Projected 5x growth in 5 years for Navigation systems and GPS devices.

Navteq maps are "touched" 100M times a day with community feedback to assist the improvement cycle of data maintenance.

In the business community merchants can directly place and edit locations They can ensure that the data is 100% up to date, this is a fee based service, helping to subsidise the service to the users. This is one of the core enablers to start to create an localise advertiser business model.

Connectivity

Consumer "touch points" have exploded at low or no cost funded by advertising systems. Information must be seamless and easily accessible 24/7. This means that always on reliable connectivity is expected. Centrally managed solutions are required to implement these dynamic features and currently the aggregation and distribution of this data needs to be defined.

With a connected device content such as downloadable POIs can be significantly increased personalised and fresh. With direct feedback into the core systems from users this will be the first step to Navigation 2.0

Promoting LBS

The Navteq LBS Challenge is a stepboard to encourage the increase in localised applications with over 500 entrants in the competition this year. Started in North America with the first European competition last year and Asia added this year with awards to be presented in Singapore in June 2008. The LBS challenge encourages companies to use leading edge technologies to develop applications and systems

Funding

Geo-advertising is estimated to generate $100m revenue in the traffic space alone. Successful campaigns will feature the following considerations

- Relevant content

- Place time context

- High value

- Must not be intrusive, but must be viewed as a value add feature which can help fund the services.

If the advertising is managed and delivered correctly then this could become a self funding service free to the end users, with little or no adverse reaction from the community. The advert content must be regarded as being more of a branding exercise than a direct sales channel.

Steve Brazier President and CEO Canalys

Where will the Navigation Industry retain it's value

Steve presented us with figures suggesting that the industry was doing better than the predictions from last year. SatNav companies were still in a very good position with Garmin doing particularly well mainly due to it's prominent market position within the American continent. Steve presented us with figures suggesting that the industry was doing better than the predictions from last year. SatNav companies were still in a very good position with Garmin doing particularly well mainly due to it's prominent market position within the American continent.

The average selling price of PNDs was still falling with the European market seeing an ASP of €272 this year falling to a projected €185 in 2010. Similarly entry level devices are expected to fall from €149 now to €99 in 2010. Worldwide the market ASP values are slightly higher at €280 but entry level is lower at €129.

Steve threw a few spanners in the works, suggesting that rather than move to single devices or connected devices it is entirely possible that the PND could be regarded as a disposable device. This would mean that users would buy a new PND every year with controlled costs rather than have a connected device with unpredictable costs.

Questions were posed about the revenue chains. Who can profit from connected devices and the content provided on them. It is a difficult proposition to make: First the user has to be persuaded to invest, then there has to be a complex revenue sharing scheme developed so that all parties can have equal benefit.

So far the market has managed to avoid the "traps" of becoming a commodity, in particular gross margins are still very strong with Garmin at just over 50% and TomTom around 45%. Compare these to the PC market where Acer only have a 10% margin.

Steve presented an analysis of the proposed TomTom acquisition of Tele Atlas. I will not cover this here as I am hoping to publish a video report of that section of his presentation.

|